Collect Cards (Single Element)

When building an e-commerce application, subscription service, or enabling one-time purchases, one of the critical requirements is collecting and storing cardholder data securely. However, it can be challenging to navigate PCI DSS and ensure that your application meets all the necessary security controls required to comply.

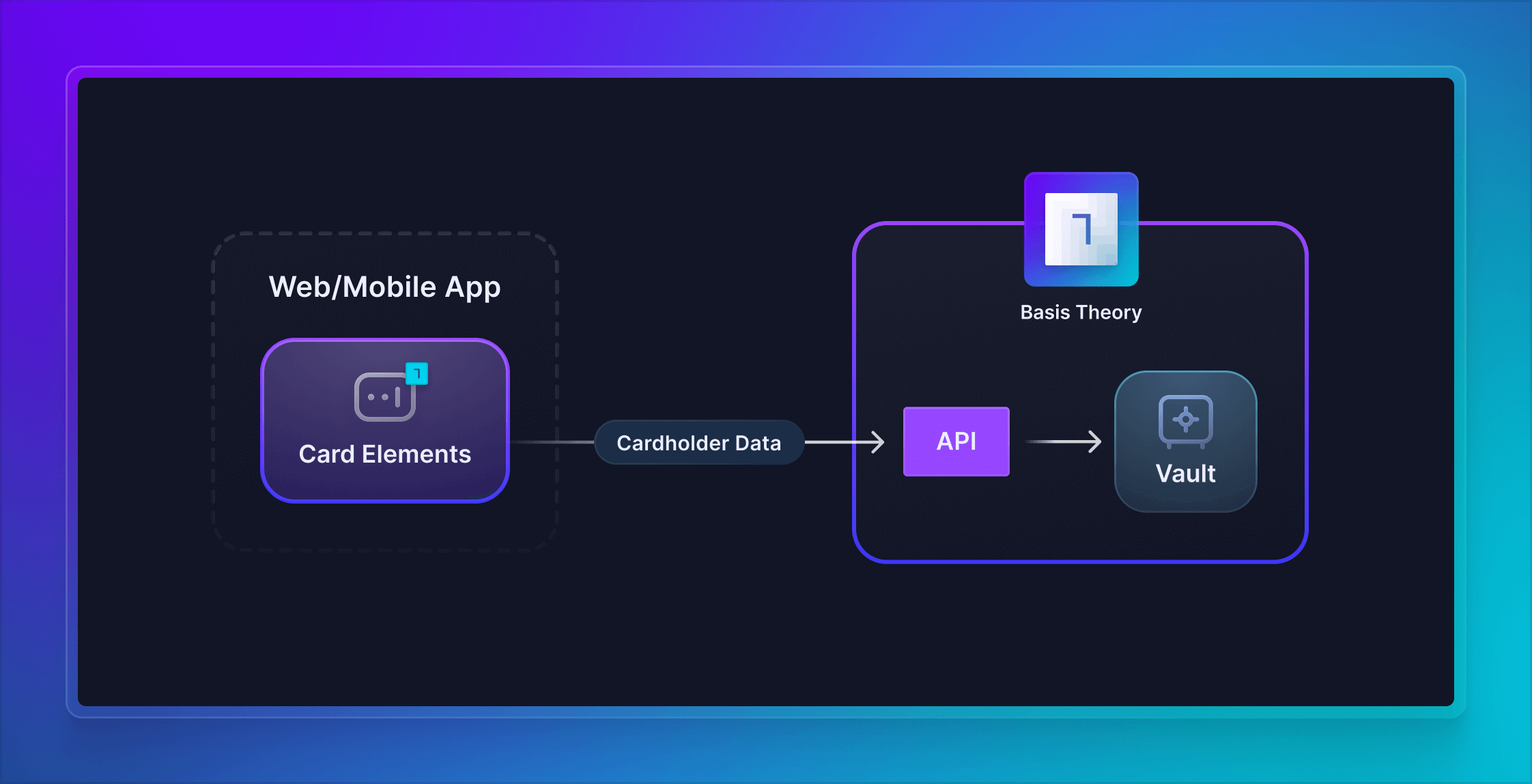

In this guide, we will set up Basis Theory SDKs to capture cards in a frontend application, Web or Mobile, and securely store the cardholder data as tokens with the Basis Theory Platform. Given this guide is followed step by step, you are substantially de-scoping your user-facing applications and database from PCI DSS compliance. If you want to learn more how we can help you meet up to 95% of the PCI requirements, or if you need help filling out your SAQ, reach out to our team!

If you are looking for a way to use your inputs to capture your user's cards, and understand the security concerns and compliance impact it represents, follow the Collect Cards With Your Inputs guide.

Getting Started

To get started, you will need to create a Basis Theory Account and a TEST Tenant.

Creating a Public Application

Next you will need a Public Application using our PCI-compliant template Collect PCI Data. Click here to create one.

This will create an application with the following Access Controls:

- Permissions:

token:create,token:update - Containers:

/pci/ - Transform:

mask

Configuring Basis Theory Elements

Basis Theory Elements are available for the following technologies. Click below for detailed instructions on how to install and configure them.

Adding Card Element

Once installed and configured, add the Card Element to your application. This will enable your users to type in their card data in your form, while ensuring your systems never come in contact with the data.

- JavaScript

- React

<div id="card"></div>

import { BasisTheory } from '@basis-theory/basis-theory-js';

let bt;

let cardElement;

async function init () {

bt = await new BasisTheory().init('<API_KEY>', { elements: true });

cardElement = bt.createElement('card');

await cardElement.mount('#card');

};

init();

import React, { useRef } from 'react';

import {

BasisTheoryProvider,

CardElement,

useBasisTheory,

} from '@basis-theory/basis-theory-react';

export default function App() {

const { bt } = useBasisTheory('<API_KEY>', { elements: true });

// Ref to get access to the Element instance

const cardRef = useRef(null);

return (

<BasisTheoryProvider bt={bt}>

<CardElement

id="myCard"

ref={cardRef}

/>

</BasisTheoryProvider>

);

}

Storing Cards

Now that you are securely capturing the cardholder data in your user-facing application(s), it is time to store it in your Basis Theory Tenant.

To do this, we will invoke the Create Token endpoint from the SDK, passing the Card Element as data in the payload. This will securely create a token by transferring the card information from the frontend Elements to Basis Theory, where the card will be strongly encrypted and stored in a compliant environment.

Add a submit function along with a button to trigger it:

- JavaScript

- React

<div id="card"></div>

<button onclick="submit();">Submit</button>

import { BasisTheory } from '@basis-theory/basis-theory-js';

let bt;

let cardElement;

async function init () { ... }

async function submit () {

try {

const token = await bt.tokens.create({

type: 'card',

data: cardElement,

});

// store token.id in your database

} catch (error) {

console.error(error);

}

}

init();

import React, { useRef, useState } from 'react';

import {

BasisTheoryProvider,

CardElement,

useBasisTheory,

} from '@basis-theory/basis-theory-react';

export default function App() {

const { bt } = useBasisTheory('<API_KEY>', { elements: true });

// Refs to get access to the Element instance

const cardElementRef = useRef(null);

const submit = async () => {

try {

const token = await bt?.tokens.create({

type: 'card',

data: cardElementRef.current,

});

// store token.id in your database

} catch (error) {

console.error(error);

}

}

return (

<BasisTheoryProvider bt={bt}>

...

<button onClick={submit}>Submit</button>

</BasisTheoryProvider>

);

}

<API_KEY> with the Public API Key you created in the Creating a Public Application step.The created card token object contains the non-sensitive information about the tokenized card, which follows the Card Token specification:

{

"id": "d2cbc1b4-5c3a-45a3-9ee2-392a1c475ab4",

"type": "card",

"tenant_id": "15f48eb5-8b52-4cdd-a396-608f7cf001d0",

"data": {

"number": "XXXXXXXXXXXX4242",

"expiration_month": 12,

"expiration_year": 2025

},

"created_by": "4a6ae2a6-79f8-4640-968f-88db913743df",

"created_at": "2023-04-17T12:54:44.8320458+00:00",

"mask": {

"number": "{{ data.number | reveal_last: 4 }}",

"expiration_month": "{{ data.expiration_month }}",

"expiration_year": "{{ data.expiration_year }}"

},

"search_indexes": [],

"containers": [

"/pci/high/"

]

}

You can safely store the token's primary key id in your database to link it with the appropriate checkout, user profile, subscription, or any other record that requires association with the card.

Notice how the card number, also known as Primary Account Number (PAN), has been masked before it is returned to your application. This default behavior prevents your application being pulled in additional PCI DSS scope, since it only comes in contact with a truncated portion of the cardholder data. Later in this guide we will learn how to customize masking.

Customizing Tokens

The steps so far cover most cases when you need to collect cards in your frontend and store them in a secure location. However, in some scenarios you may need to customize your card tokens for specific business needs or technical requirements. In the following sections, you will find optional steps to follow for common problems solved by Basis Theory Token capabilities.

Deduplication

Companies often find it necessary to uniquely identify cards flowing through their systems for various reasons, which may include: preventing fraudulent transactions, detecting credit cards abuse, building consumer profiles or streamlining payment processing for a better user experience.

By leveraging token fingerprinting, developers can recognize the tokenized data in a customizable fashion, without having to touch with the plaintext data. For cards, it is common to index in the Primary Account Number (PAN). In some cases the expiration date may also be considered.

When making the tokenization request to store the card, pass a fingerprint expression to instruct Basis Theory to calculate the fingerprint for the sensitive data field:

- JavaScript

- React

async function submit () {

try {

const token = await bt.tokens.create({

type: 'card',

data: cardElement,

fingerprintExpression: '{{ data.number }}',

});

} catch (error) {

console.error(error);

}

}

export default function App() {

const submit = async () => {

try {

const token = await bt?.tokens.create({

type: 'card',

data: cardElementRef.current,

fingerprintExpression: '{{ data.number }}',

});

} catch (error) {

console.error(error);

}

}

return (...);

}

The new tokens should now have a fingerprint:

{

"id": "d2cbc1b4-5c3a-45a3-9ee2-392a1c475ab4",

"type": "card",

"tenant_id": "15f48eb5-8b52-4cdd-a396-608f7cf001d0",

"data": {

"number": "XXXXXXXXXXXX4242",

"expiration_month": 12,

"expiration_year": 2025

},

"created_by": "4a6ae2a6-79f8-4640-968f-88db913743df",

"created_at": "2023-04-17T12:54:44.8320458+00:00",

"fingerprint": "CC2XvyoohnqecEq4r3FtXv6MdCx4TbaW1UUTdCCN5MNL",

"fingerprint_expression": "{{ data.number }}",

"mask": {

"number": "{{ data.number | reveal_last: 4 }}",

"expiration_month": "{{ data.expiration_month }}",

"expiration_year": "{{ data.expiration_year }}"

},

"search_indexes": [],

"containers": [

"/pci/high/"

]

}

If you want to prevent creation of a duplicate token based on the distinguishable fingerprint, add the flag below:

- JavaScript

- React

async function submit () {

try {

const token = await bt.tokens.create({

type: 'card',

data: {

number: cardElement,

},

fingerprintExpression: '{{ data.number }}',

deduplicateToken: true,

});

} catch (error) {

console.error(error);

}

}

export default function App() {

const submit = async () => {

try {

const token = await bt?.tokens.create({

type: 'card',

data: cardElementRef.current,

fingerprintExpression: '{{ data.number }}',

deduplicateToken: true,

});

} catch (error) {

console.error(error);

}

}

return (...);

}

By doing the above, you are instructing Basis Theory to return the existing token if it is found to have the same fingerprint. Click here to learn more about token deduplication.

Masking

By default, card tokens are created with a mask revealing only the last 4 digits of the card number. This is useful for generating receipts and payment history, displaying the card to the end-user without revealing the full number, etc.

In other scenarios, being able to preserve the Bank Identification Number (BIN) from the card number can enable fraud detection, payment processing, customer service or account management. PCI DSS allows applications to reveal up to the first 8 and last 4 digits of a card number, depending on its length and Payment Brand. Luckily, when creating a token, you can express which segments of the PAN are useful to you with a single expressions filter: card_mask. Click here to learn more about this filter.

- JavaScript

- React

async function submit () {

try {

const token = await bt.tokens.create({

type: 'card',

data: cardElement,

fingerprintExpression: '{{ data.number }}',

deduplicateToken: true,

mask: {

number:'{{ data.number | card_mask: "true", "true" }}',

expiration_month: '{{ data.expiration_month }}',

expiration_year: '{{ data.expiration_year }}',

},

});

} catch (error) {

console.error(error);

}

}

export default function App() {

const submit = async () => {

try {

const token = await bt?.tokens.create({

type: 'card',

data: cardElementRef.current,

fingerprintExpression: '{{ data.number }}',

deduplicateToken: true,

mask: {

number:'{{ data.number | card_mask: "true", "true" }}',

expiration_month: '{{ data.expiration_month }}',

expiration_year: '{{ data.expiration_year }}',

},

});

} catch (error) {

console.error(error);

}

}

return (...);

}

Now, the created token should also reveal the BIN:

{

"id": "d2cbc1b4-5c3a-45a3-9ee2-392a1c475ab4",

"type": "card",

"tenant_id": "15f48eb5-8b52-4cdd-a396-608f7cf001d0",

"data": {

"number": "42424242XXXX4242",

"expiration_month": 12,

"expiration_year": 2025

},

"created_by": "4a6ae2a6-79f8-4640-968f-88db913743df",

"created_at": "2023-04-17T12:54:44.8320458+00:00",

"fingerprint": "CC2XvyoohnqecEq4r3FtXv6MdCx4TbaW1UUTdCCN5MNL",

"fingerprint_expression": "{{ data.number }}",

"mask": {

"number": "{{ data.number | card_mask: 'true', 'true' }}",

"expiration_month": "{{ data.expiration_month }}",

"expiration_year": "{{ data.expiration_year }}"

},

"search_indexes": [],

"containers": [

"/pci/high/"

]

}

In the example above, we instruct Basis Theory to reveal both segments, without having to worry about the card brand or number length. Click here to learn more about Masking.

Aliasing

While storing or transmitting tokens between systems, you may encounter restrictive technical constraints that can draw the default token Universally Unique Identifier (UUID) incompatible.

In the example below, we will pass a predefined token id that follows a custom logic, which resembles an alternative format used in the payments industry. This capability enables Token Portability, and it can be specially useful in migration scenarios.

- JavaScript

- React

function generateTokenId() {

const chars = 'ABCDEFGHIJKLMNOPQRSTUVWXYZabcdefghijklmnopqrstuvwxyz0123456789';

let tokenId = 'card_';

for (let i = 0; i < 24; i++) {

tokenId += chars.charAt(Math.floor(Math.random() * chars.length));

}

return tokenId;

}

async function submit () {

try {

const token = await bt.tokens.create({

id: generateTokenId(),

type: 'card',

data: cardElement,

fingerprintExpression: '{{ data.number }}',

deduplicateToken: true,

mask: {

number:'{{ data.number | card_mask: "true", "true" }}',

expiration_month: '{{ data.expiration_month }}',

expiration_year: '{{ data.expiration_year }}',

},

});

} catch (error) {

console.error(error);

}

}

const generateTokenId = () => {

const chars = 'ABCDEFGHIJKLMNOPQRSTUVWXYZabcdefghijklmnopqrstuvwxyz0123456789';

let tokenId = 'card_';

for (let i = 0; i < 24; i++) {

tokenId += chars.charAt(Math.floor(Math.random() * chars.length));

}

return tokenId;

}

export default function App() {

const submit = async () => {

try {

const token = await bt?.tokens.create({

id: generateTokenId(),

type: 'card',

data: cardElementRef.current,

fingerprintExpression: '{{ data.number }}',

deduplicateToken: true,

mask: {

number:'{{ data.number | card_mask: "true", "true" }}',

expiration_month: '{{ data.expiration_month }}',

expiration_year: '{{ data.expiration_year }}',

},

});

} catch (error) {

console.error(error);

}

}

return (...);

}

The returned token object should now have a custom identifier:

{

"id": "card_1Mxqr82eZvKYlo2CSaatci3m",

"type": "card",

"tenant_id": "15f48eb5-8b52-4cdd-a396-608f7cf001d0",

"data": {

"number": "42424242XXXX4242",

"expiration_month": 12,

"expiration_year": 2025

},

"created_by": "4a6ae2a6-79f8-4640-968f-88db913743df",

"created_at": "2023-04-17T12:54:44.8320458+00:00",

"fingerprint": "CC2XvyoohnqecEq4r3FtXv6MdCx4TbaW1UUTdCCN5MNL",

"fingerprint_expression": "{{ data.number }}",

"mask": {

"number": "{{ data.number | card_mask: 'true', 'true' }}",

"expiration_month": "{{ data.expiration_month }}",

"expiration_year": "{{ data.expiration_year }}"

},

"search_indexes": [],

"containers": [

"/pci/high/"

]

}

Similarly to masking, aliasing also supports passing custom data-bound expressions, that can generate length and format-preserving token identifiers. Doing such increases compatibility to store or pass tokens between systems, white preserving information about the tokenized data.

For example, use the alias_card filter to generate a synthetic card number as a token identifier, which shares the same BIN and last four digits of the real card number. Click here to learn more about Aliasing.

Conclusion

The best practices prescribed in this guide ensure that your user-facing applications are compliant with the PCI-DSS standards and your users' sensitive card data is protected. The token.id obtained at the end of the Storing Cards section is a synthetic replacement for the sensitive data and can be safely stored in your database, or transmitted through your systems, meeting compliance requirements and reducing the risk of exposure in case of data breaches.

The optional customization steps are meant to showcase platform capabilities that go beyond the examples given. Make sure to explore the provided links within each subsection to learn more about the possibilities for customization.

For next steps, take a look at the following guides to proceed taking the most value of your secured card tokens: